March 2020: Last week, the National Park Service released the Federal Tax Incentives for Rehabilitating Historic Buildings Annual Report for Fiscal Year 2019. The Federal Historic Tax Credit (HTC), administered by the National Park Service in partnership with the State Historic Preservation Offices, is the nation’s most effective incentive to promote historic preservation and community revitalization through historic rehabilitation.

With over 45,000 completed projects since its enactment in 1976, the HTC has leveraged over $160 billion (inflation-adjusted) in private investment in the rehabilitation of historic properties—spurring the rehabilitation of historic structures of every period, size, style, and type in all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

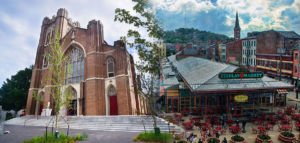

The NTCIC supported Rose Collaborative in New Orleans, LA and the Jobs Cafe in Cincinnati, OH were among projects that Placed in Service in 2019 after receiving their Part III approval from the NPS.

FY 2019 Annual Report Highlights:

- 1,042 completed projects generated and estimated $5.77 in estimated rehabilitation costs (QREs)

- Of all projects completed in 2019:

- 49% were under $1 million in rehab costs (compared to 46% in 2018)

- 27% were between $1 million and $5 million in rehab costs (comparted 28% in 2018)

- 20% were between $5 million and $25 million in rehab costs (identical to 2018)

- 4% were over $25 million in rehab costs of all projects (comparted 6% in 2018)

- 16,280 housing units generated (6,564 rehabilitated/9,716 new)

- 6,206 low- and moderate-income housing units created

- 15% of projects did not yet list on the National Register of Historic Places

- 1,317 preliminary Part 2 certifications (compared to 1,479 in 2018)

- 1,501 Part 1 certifications of historical significance (compared 1,805 in 2018)

Program Highlights:

Since the inception of the HTC more than 40 years ago:

- 604,004 housing units (291,828 rehabilitated/312,176 new) generated

- 172,416 low- and moderate-income housing units created

NTCIC is working with the Historic Tax Credit Coalition, the National Trust for Historic Preservation, as well as other preservationists and members of the historic rehab industry, to improve the Historic Tax Credit. We encourage you to join us as advocates for the Historic Tax Credit Growth and Opportunity Act (HTC-GO), which will bring more value to HTCs and make the credit easier to use on main street, in rural areas, and for community impact projects led by non-profits.

Senator Cassidy (R-LA), Senator Cardin (D-MD), Senator Collins (R-ME) and Senator Cantwell (D-WA) introduced the Senate version of the HTC-GO (S. 2615) last October and the legislation presently has 12 Senators signed on as cosponsors. The similar House version of HTC-GO (H.R. 2825), introduced last May by Rep. Blumenauer (D-OR) Rep. LaHood (R-IL), Rep. Sewell, (D-AL), and Rep. Kelly (R-PA), presently has 64 cosponsors.

For guidance on how to ask your Members of Congress to cosponsor HTC-GO (H.R. 2825/ S. 2615), click below.

NTCIC Advocacy Guide

How to Ask Your Members of Congress to Cosponsor HTC-GO

While HTC advocates were hopeful there would be a grand deal on tax issues in 2019, negotiations among Congressional leaders and the White House broke down in mid-December, forcing the parties to settle for a smaller “skinny tax” agreement. In 2020, HTC advocates will have the opportunity to gain co-sponsorship and strengthen support for HTC-GO to positively position the bill for a year-end tax bill. Learn how you can advocate making this happen! | HTC-GO Advocacy Guide